child tax credit 2021 eligibility

Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December. The IRS bases your childs eligibility on their age on Dec.

Biden S 15 000 First Time Homebuyer Tax Credit Tax Credits Home Buying First Time

The iPhone at 15 Louis Vuitton smartwatch CES 2022 takeaways Attack on Titan final season Golden Globes 2022 How to find at-home COVID-19 tests.

. Up to 1800 for each child up to age 5 and up to 1500 for each child age 6-17. If you are eligible for the Child Tax Credit but did not get any advance payments in 2021 you can still get a lump-sum payment by claiming the Child Tax Credit benefit when you file. Parents who are eligible will automatically get 50 of their 2021 child tax credit amount through six advance monthly installments and.

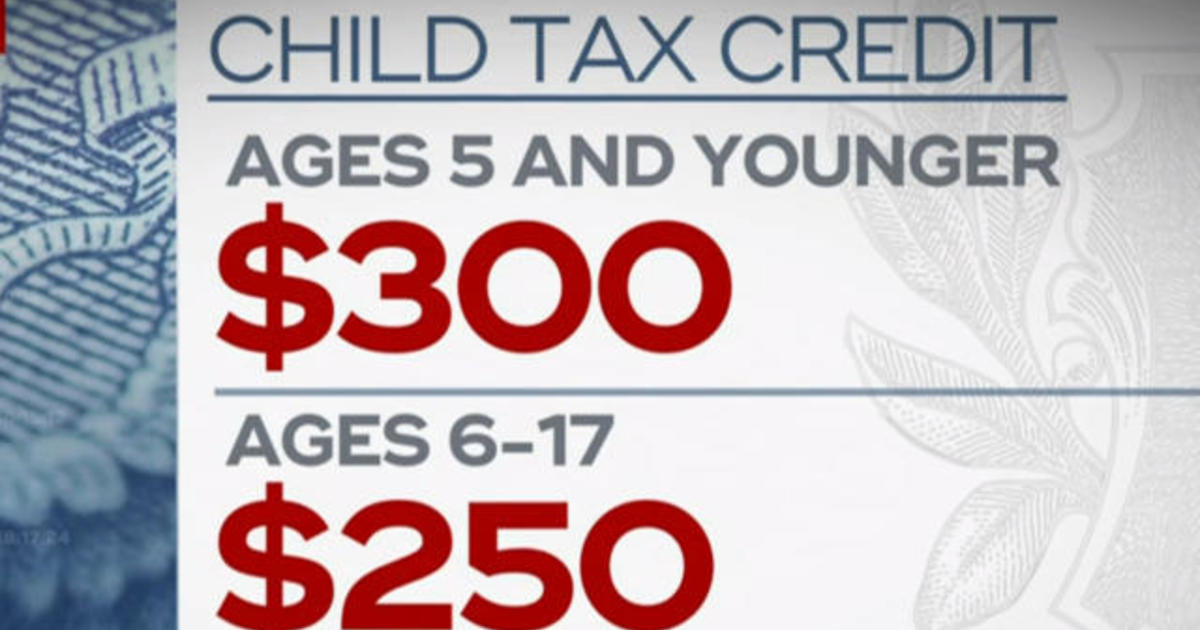

Last March Congress added a second expansion of the credit just for 2021 as part of its pandemic response. The advance is 50 of your child tax credit with the rest claimed on next years return. The monthly advance Child Tax Credit payments were as much as 300 for each child under six and 250 for each child six and older.

But if youre having a baby in 2021 you wont get the money until later. It added one year to the threshold age of the child. Maximum Child Tax Credit In 2021.

An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. Up to 96 of US households with children qualify for at least some of the 2021 child tax credit. So under the new law children up to 17 years are eligible for the child tax credit.

How much is the child tax credit worth. The 2021 child tax credit provides parents with up to 3600 per child for kids under 6 and 3000 for all other children under 18 with half of the money being doled out as monthly payments that. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit.

Ad The new advance Child Tax Credit is based on your previously filed tax return. Have a valid Social Security number. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families.

3600 per child under 6 years old. Making a new claim for Child Tax Credit. In the tax year 2021 under the new provisions families are set.

If taxpayers received more advanced. For each kid between the ages of 6 and 17 up to 1500 will come as 250 monthly payments six times this year. Previously only children 16 and younger qualified.

If you had dependents who were 18 years old or full-time college students through age 24 the IRS should have sent you a one-time payment of 500. The expanded CTC is for your 2021 tax return which you file in 2022. The amount you can get depends on how many children youve got and whether youre.

The maximum total amount of CTC for 2021 is 3000 per child under 18 years old and 3600 per child under 6 years old. Ad Explore detailed reporting on the Economy in America from USAFacts. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the.

The 2021 child tax credit is also a fully refundable tax credit so if youâre eligible for a credit thatâs worth more than the total amount of tax you owe you can still receive the excess credit as a tax refund. The IRS will soon allow claimants to adjust their income and custodial. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000.

Generally to be eligible for the Earned Income Tax Credit you must. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. Parents income matters too.

A childs age determines the amount. The remaining half of the credit for eligible may be claimed when the advanced payments are reconciled with the total eligible Child Tax Credit on the 2021 income tax return. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17.

The payment for children. But age and income requirements could make families completely ineligible. There are basic eligibility rules that apply to most everyone.

Eligible children must have a Social Security Number. Have earned income through work during 2021. This expanded child credit is in effect for 2021 and 2022 and it expires at the end of 2025.

If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying child for purposes of the 2021 Child Tax Credit. The CTC income limits are the same as last year but there is no longer a minimum income so anyone whos otherwise eligible can claim the child tax. The American Rescue Plan ARP temporarily expands the Child Tax Credit CTC from 2000 per child to as high as 3600 for the 2021 tax year.

Already claiming Child Tax Credit. In previous years 17-year-olds werent covered by the CTC. The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements.

For both age groups the rest of the payment will come with your 2021 tax. Starting July 15 the first half of the CTC will be automatically deposited in monthly payments of 300 or 250 into the bank accounts of most eligible families. 3000 per child 6-17 years old.

Meet the income requirements which are different depending on whether you have children and are filing taxes. All children under 18 are eligible for the child tax credit. This amount begins to decrease when an individual has income higher than 75000 112500 for Head of Household and 150000 for married couples.

Youll claim the other half of the credit when you file your 2021 taxes due April 18 2022. Use our child tax credit calculator to determine your eligibility for tax year 2020 or tax year 2021. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line.

Length of residency and 7. The ARP also enhanced eligibility. 31 2021 so a 5-year-old child turning 6 in 2021 will qualify for a maximum of 250 per month.

As a result you were eligible to receive advance Child Tax Credit payments for your qualifying child. Visualize trends in state federal minimum wage unemployment household earnings more. Finally if the qualifying children you listed in a Non-Filer Tool in 2020 or 2021 are the same qualifying children you had in 2021 you probably only received.

Along with 1400 stimulus checks and enhanced unemployment benefits the package includes updates to the current child tax credit. Citizen or a resident alien for all of 2021. You andor your child must pass all seven to claim this tax credit.

The full CTC provides families with. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Your amount changes based on the age of your children.

The credits scope has been expanded.

Apply Online For Gst Registration Accounting Services Registration Apply Online

Find Out If You Qualify For Financial Assistance Video Health Plan How To Plan Department Of Social Services

A New Report From The Nonprofit Nonpartisan Tax Foundation Indicates Only France S 36 Percent Corporate Tax Rate Is Hig Tax Deductions Income Tax Filing Taxes

Lic Jeevan Shanti Single Premium Guaranteed Pension Plan Eligibility Single Premium Shanti How To Plan

Common Credit An Important Part Of Input Tax Credit Under Gst In 2021 Tax Credits Tax Credits

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

How Do Employers Set Up An Ichra Health Insurance Plans Types Of Health Insurance Affordable Health Insurance

A Brief Guide To The Child Tax Benefit In Canada

What To Know About Student Loan Forgiveness In 2021 Student Loan Forgiveness Student Loans Student Loan Debt

Flowchart Is Your Business Eligible For The Employee Retention Credit In 2021 Employee Retention Small Business Finance Tax Credits

Gst Taxes Replaced And Taxes Not Replaced Http Www Accounts4tutorials Com 2017 06 Gst Short Not Goods And Service Tax Economics Lessons Financial Management

Older Adults And Third Stimulus Checks Eligibility Rules And What They Mean For You Free Amazon Products Retired People Older Adults

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

Child Tax Credit 2021 2022 Explained And What It Means For Your Taxes Thestreet Turbotax Youtube